Recession Survival Guide: Learn Which Industries Beat Every Recession

Not all stocks sink in a downturn. Utilities rose while tech tanked in ’01. Here’s how to pick the lifeboats that'll save you in the next economic storm.

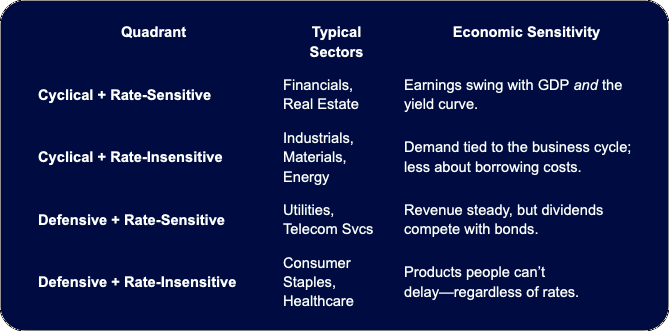

Macro Map — The Grid Every Recession Investor Should Know

Think of the equity universe as a chessboard split along two axes:

Cyclical ↔ Defensive

Interest-rate Sensitive ↔ Insensitive

Economic sensitivity is the degree to which a sector’s revenues and margins correlate with real GDP growth and consumer confidence. Utilities score low (elasticity ≈ 0.3), while Industrials and Consumer Discretionary often exceed 1.0.

Three Ways to Spot a Lifeboat (with Real ETFs)

Using all lenses forms a confirmation triangle—when macro, micro, and price-action all agree, sector rotation conviction skyrockets.

Data Dive — Who Won and Lost in the Last Three U.S. Recessions?

Key pattern: sectors tied to necessity (power, food, basic health) or to indispensable infrastructure of the moment (cloud & e-commerce in 2020) routinely outrun the index when GDP turns negative.

Why Some Industries Float While Others Sink

Demand Inelasticity — Consumers keep lights on and buy medicine regardless of layoffs.

Regulated Revenue — Utilities earn allowed returns set by Public Utility Commissions, limiting downside.

Balance-Sheet Buffers — Staples and Health Care carry lower leverage, reducing refinancing risk when credit spreads blow out.

Pricing Power — Brands like Procter & Gamble can pass through inflation, protecting margins.

Capital Cyclicality — Energy and Industrials often embark on cap-ex binges after good times, which collide head-on with recessions.

Looking for the best Monopoly ETFs to invest in?

Check out Monopoly Hunters’ Top Monopoly ETF page on our website to learn about the different monopoly and oligopoly ETFs and what each one has to offer.

Looking for a way to track your investments (in one place)?

Visit Monopoly Hunters’ Free Resources page to download our Ultimate Investment Tracker. It’s free and lets you track all your investments in a single Google Sheet.