Quality Growth ≠ Growth Stocks: Netflix Under the Microscope

Fast-growing revenues can mask fragile foundations. “Quality growth” investors insist the numbers compound and endure—an acid test many glamour stocks fail. Netflix is a textbook case.

Growth, But at What Quality?

Wall Street often bundles every double-digit grower into the same “growth” bucket, yet Peter Seilern’s Only the Best Will Do draws a sharp line: real quality growth companies must clear ten Golden Rules, including durable competitive advantage, high returns on capital, fortress balance sheets, transparent accounts and exceptional governance. That rigor shrinks a 58,000-stock universe to 50–70 names—roughly the 0.1 % crème de la crème. These are the stocks that you should invest in.

Key distinction:

Momentum-only growth = price chases rapid revenue stories,

often fuelled by leverage or equity dilution.Quality growth = price follows profitable expansion,

protected by high ROIC and low capital intensity.

Seilern’s research shows that businesses scoring highest on quality metrics compound “significantly more money… and use capital much more efficiently” than the S&P 500 average . Over decades, that translates into both higher returns and lower risk.

Proof in the Pudding — Quality Outperformance

Investors in Seilern’s World Growth Fund (launched 1996) have seen capital grow eight-fold—beating MSCI World by 322% over the period. The secret isn’t fancy factor timing; it’s focus on companies whose average ROIC hovers near 25%, double the index. Put plainly: when earnings, cash flow and governance keep compounding, the share price eventually follows—regardless of market mood swings.

Enter Netflix: Growth Darling or Quality Pretender?

In the 2010s, Netflix re-wrote entertainment and its stock price followed, rallying more than 5,000%. But can it join the quality-growth hall of fame?

Seilern’s own verdict is blunt:

“Netflix is a growth business all right, but one which does not pass the test of quality, thanks to its high debt levels… Returns to shareholders will be at the mercy of the debt markets”.

3.1 Balance-Sheet Reality

While free cash flow has jumped—helped by password-crackdowns and an ad-supported tier—the company still carries leverage built up over a decade of content spending. Until that balance-sheet risk moderates, Netflix remains a momentum-to-profitability crossover, not a proven quality compounder.

3.2 Transparency & Governance

Streaming metrics, amortization of licensed content and constant metric changes (remember DVD to streaming transition, now dropping subscriber disclosure) muddy the financial picture. Rule 9 (“transparent accounts”) isn’t satisfied, and concentration risk (Hollywood strikes, bidding wars) challenges Rule 4 (sustainable advantage).

3.3 Market Message

When rates spiked in 2022, Netflix shares cratered 75%.

Quality growth names also fell, but their earnings held steady; Netflix’s profits shrank as content costs kept burning. Seilern’s book reminds us: “Form is temporary, but class is permanent.” Price recovered in 2023–24, yet that rebound reflects optimism about advertising and live sports—not (yet) a seasoned quality scorecard.

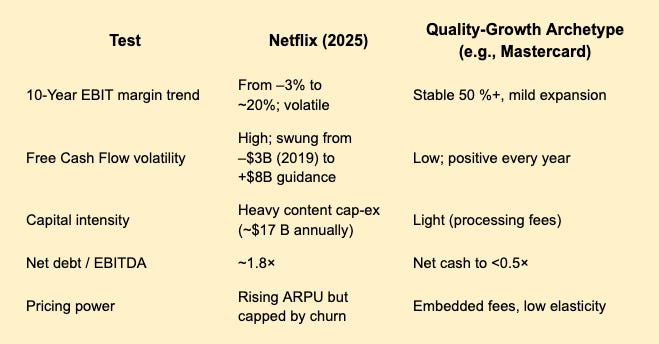

Profitability > Popularity: A Side-by-Side Diagnostic

Why Quality Beats Momentum Over Full Cycles

High ROIC compounds faster — Every dollar reinvested at 25 % ROIC doubles in ~3 years. Momentum names often reinvest at single-digit returns, masking dilution with headline revenue growth.

Balance-sheet optionality — Net-cash businesses can buy rivals or accelerate buybacks when bear markets strike; leveraged growers slash spend instead.

Predictability attracts patient capital — Pension funds and endowments stick with stalwarts, lowering volatility and cost of capital.

Governance reduces blow-ups — Transparent accounting limits Enron-style surprises.

Those advantages are why Seilern dubs quality growth a “holy grail” that delivers “higher returns and below-average risk”.

Screening for Tomorrow’s Quality-Growth Stars

Use Seilern’s Golden Rules as a checklist:

Superior industry growth yet not fad-driven.

Consistent leadership—top-two market share.

Scalable model with low incremental costs.

Wide moat—network effects, IP or regulation.

Organic growth, not acquisition roll-ups.

Diversified revenue base across regions.

High ROIC, low cap-ex.

Net-cash balance sheet.

Clean, transparent accounts.

A-grade management & governance.

Only when a company ticks all ten does it graduate from “growth” to “quality growth”.

Looking for the best Monopoly ETFs to invest in?

Check out Monopoly Hunters’ Top Monopoly ETF page on our website to learn about the different monopoly and oligopoly ETFs and what each one has to offer.

Looking for a way to track your investments (in one place)?

Visit Monopoly Hunters’ Free Resources page to download our Ultimate Investment Tracker. It’s free and lets you track all your investments in a single Google Sheet.