Buffett vs Dalio: Which Recession Strategy Comes Out On Top?

When markets nosedive, value-hunters quote Warren Buffett’s “be greedy when others are fearful,” while macro buffs load Ray Dalio’s All-Weather playbook.

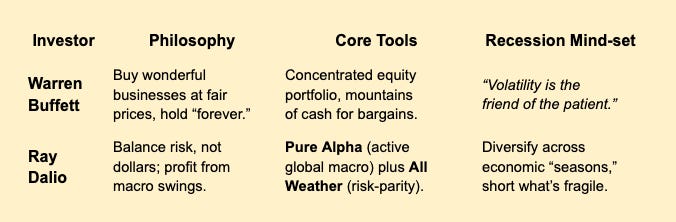

Meet the Titans & Their Playbooks

Buffett wagers that quality endures, Dalio posits that diversification across asset classes beats guessing the cycle. They’re two different playbooks, but which one triumphs?

Scorecard: Three Recessions, Three Rounds

Why Each Strategy Wins (and When It Doesn’t)

Buffett’s Edge

Durable moats: Coca-Cola & Apple print cash even in lean years.

Fortress balance sheets: Berkshire’s cash pile tops $270 bn, letting him buy when credit freezes.

Structural patience: No forced redemptions, so he can wait for recovery.

Weak spot: Heavy equity beta means deep drawdowns when leverage‐driven crises (2008) smash valuations.

Dalio’s Edge

Risk-parity math: Bonds and gold offset equity pain—works when bonds rally.

Active macro layer: Pure Alpha shorts bubbles it diagnoses (2008 sub-prime).

Systematic rebalancing: Quarterly resets curb emotion.

Weak spot: Regime shifts (zero-rates, QE, pandemic) can break historical hedges; All-Weather stumbled in 2020 as bonds and stocks fell together.

Implementation Cheatsheet for Everyday Investors

6 / So…Who Wins?

Capital Preservation: Dalio edges out—2008 proved the power of risk balancing.

Long-Term Compounding: Buffett’s 10.5 % CAGR after tax since 2003 roughly matches the S&P, but with a human narrative investors can stick with.

Behavioral Fit: The strategy you can execute always beats the one you abandon. If daily volatility makes you bail, an All-Weather glide path may keep you invested; if complexity breeds doubt, the Buffett “buy what you understand” mantra wins.

Verdict: In a credit-driven, deflationary crash, Dalio historically shines; in inflationary or supply-shock recessions, Buffett’s real-asset businesses and cash war-chest pull ahead.

The “winner” therefore changes with the macro script.

Looking for the best Monopoly ETFs to invest in?

Check out Monopoly Hunters’ Top Monopoly ETF page on our website to learn about the different monopoly and oligopoly ETFs and what each one has to offer.

Looking for a way to track your investments (in one place)?

Visit Monopoly Hunters’ Free Resources page to download our Ultimate Investment Tracker. It’s free and lets you track all your investments in a single Google Sheet.

Bottom Line

Catastrophic loss isn’t lightning—it’s usually a slow leak in one of the seven staying‑power pipes. By seeing where sectors historically fail, studying high‑profile implosions, and wiring defensive rules into your portfolio, you can sidestep the fate that has claimed nearly half of public companies since 1980.

Stay curious, stay diversified, and stay standing.